Tim Boyle/Getty Images News

Despite reportedly having ceased operations nationwide and a bankruptcy filing likely being imminent, shares of ailing trucking giant Yellow Corporation's (NASDAQ:YELL) have become the latest playground of meme stock traders.

After trading as low as $0.43 last week, shares have exploded on massive volume over the past couple of sessions and reached an intra-day high of $4.89 in late trading on Tuesday.

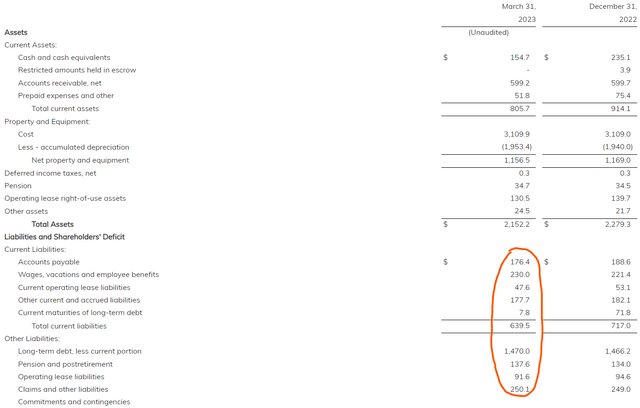

With the remains of the company potentially being liquidated in bankruptcy and more than $2.5 billion in debt and other unsecured claims ranking ahead of shareholders at the end of Q1, a recovery for common equity holders looks close to impossible even when generously assuming sales proceeds for the company's assets being close to or even somewhat higher than book value:

Company Press Release

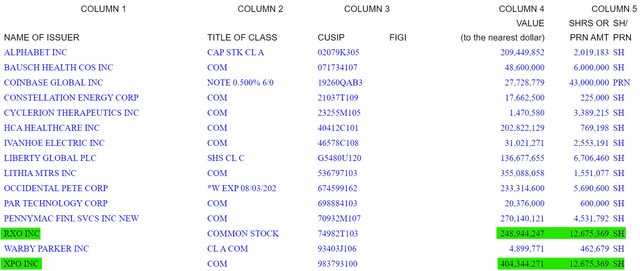

Apparently, the company's bleak outlook hasn't worried Boston-based hedge fund MFN Partners which also owns sizeable stakes in competitors XPO Inc. (XPO) and RXO Inc. (RXO) according to its most recent 13F-HR filed with the SEC in May:

MFN Partners Regulatory Filing

Over the past month, MFN Partners has built an eye-catching 42.5% stake in Yellow Corporation without making any sort of public statement regarding its intentions in light of the company's dismal financial condition.

At least in my opinion, there's little sense in taking control of the company with all its financial obligations still firmly in place and customers already having shifted volumes to competitors in recent weeks.

Moreover, with creditors led by Apollo Global Management Inc. (APO) reportedly nearing a deal to provide super-senior debtor-in-possession ("DIP") financing to keep the company afloat during bankruptcy, there would be even more debt ahead of common shareholders.

From my perspective, there's very little reason for creditors to share potential sales proceeds with common equity holders or provide them a stake into a restructured Yellow Corporation.

The entire situation actually reminds me of hedge fund's Luminus Management's failed bet on financially distressed offshore driller Valaris (VAL) back in 2019 that ended with an almost total loss after the company restructured in bankruptcy.

No matter how you slice it, I just don't see MFN Partners taking the company private at the current $1.6 billion enterprise value and I don't see them injecting large amounts of new capital in the cash-strapped business either.

Some investors might envision a transaction involving XPO Inc. but there would be no need for an involvement of MFN Partners in this case.

But perhaps MFN Partners is just looking to replicate Ryan Cohen's stunt with shares of struggling retailer Bed, Bath & Beyond (OTCPK:BBBYQ).

Bottom Line

Quite frankly, even with the recent involvement of MFN Partners, I am struggling to envision a positive outcome for Yellow Corporation's common shareholders, particularly with Apollo Global Management reportedly preparing to provide super-senior DIP financing in the upcoming bankruptcy.

With operations already having ceased, there's simply no sense in taking control of the ailing company and assuming its massive debt obligations.

Should Yellow Corporation indeed file for bankruptcy, a recovery for common equity holders would be highly unlikely.

Given these issues, I would advise investors to use the ongoing rally to exit existing positions and move on.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

"crowd" - Google News

August 02, 2023 at 03:26AM

https://ift.tt/8d0LSl5

Yellow Corporation: MFN Partners Stake Accumulation Unleashes Meme Stock Crowd - Seeking Alpha

"crowd" - Google News

https://ift.tt/HtQjlyw

https://ift.tt/oyWlpFn

Bagikan Berita Ini

0 Response to "Yellow Corporation: MFN Partners Stake Accumulation Unleashes Meme Stock Crowd - Seeking Alpha"

Post a Comment