The market remained weak for the third consecutive week but traded largely within the previous week's range of 19,300-19,800, which is likely to be crucial for either side of direction, going ahead. If the index breaks 19,300, then it may get the next support around 19,000, whereas on the higher side, 19,600-19,650 is expected to be a crucial hurdle in the near term, experts said. According to them, 18,850-18,900 is likely to be crucial support area, which also coincides with horizontal resistance trendline adjoining highs of November 2022 and the week ended June 23.

The Nifty50 fell 0.45 percent or 89 points to 19,428 for the week ended August 11, forming a bearish candlestick pattern with lower highs for the third straight week on the weekly scale.

"On the weekly and monthly chart, positional trend of the Nifty seems very strong, but definitely there is a sign of weakness in the index for the short term and the index could extend its correction but we believe that the downside in the market would be limited," Vinay Rajani, CMT, senior technical and derivative analyst at HDFC Securities. said.

He feels the first semblance of support is expected in the 19,050-19,100 zone. If this zone is broken, then the next support comes in the zone of 18,850-18,900 which, he thinks, would be a good buying opportunity in the index. Any level above 19,650 in the near term, would negate the short-term downtrend, he says.

Considering the current scenario, Osho Krishan, senior analyst - technical and derivative research at Angel One, advised to avoid undue risk and aggressive trades in the indices.

The broader market space is keeping up the buzz, in which one needs to be very selective while choosing stock-centric moves for an outperformance, he says.

Let's take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the August 11 closing prices:

Expert: Vinay Rajani, CMT, senior technical & derivative analyst at HDFC Securities

Bank Of India: Buy | LTP: Rs 87 | Stop-Loss: Rs 82 | Targets: Rs 95-100 | Return: 15 percent

The stock price has broken out from the symmetrical triangle on the weekly chart with rising volumes. PSU banking as a sector has been outperforming for last couple of months.

The stock is placed above all important moving averages, which indicates bullish trend on all time frames. After few weeks of consolidation, stock seems to have resumed primary uptrend.

Tata Communications: Buy | LTP: Rs 1,680 | Stop-Loss: Rs 1,611 | Targets: Rs 1,803-1,890 | Return: 12.5 percent

Primary trend of the stock has been bullish with higher tops and higher bottoms on the weekly charts. Stock price has been finding support on its 20 DEMA (exponential moving average).

The stock has recently shown throwback fall towards its previous top support. ADX (average directional index) Indicator has turned in to bullish trend. Stock is placed above all important moving averages, which indicates bullish trend on all time frames.

Jubilant Pharmova: Buy | LTP: Rs 447 | Stop-Loss: Rs 415 | Targets: Rs 485-540 | Return: 21 percent

The stock price has broken out from the Cup and Handle pattern on the weekly chart with jump in volumes. Stock price has also broken out from the bullish “Flag” pattern on the weekly chart.

The stock price has surpassed the double top resistance of Rs 421 on closing basis. Indicators and oscillators have turned bullish on the weekly and monthly charts.

Expert: Shrikant Chouhan, head of equity research (retail) at Kotak Securities

Reliance Industries: Buy | LTP: Rs 2,547 | Stop-Loss: Rs 2,475 | Targets: Rs 2,650-2,660 | Return: 4.4 percent

After a short-term correction, the stock took the support near Rs 2,465 and reversed. Post reversal, it has formed higher bottom formation on daily and intraday charts, which is largely positive.

Currently, the stock is witnessing positive consolidation near 20-day SMA (simple moving average) which indicates strong possibility of fresh uptrend rally from the current levels.

Unless it is trading below Rs 2,475, positional traders retain an optimistic stance and look for a target Rs 2,650-2,660. Fresh buying can be considered now and on dips, if any between Rs 2,550 and Rs 2,500 levels with a stop-loss below Rs 2,475.

Bajaj Finserv: Buy | LTP: Rs 1,504 | Stop-Loss: Rs 1,465 | Targets: Rs 1,600-1,620 | Return: 8 percent

After a sharp correction eventually, the stock took the support near 200-day SMA and reversed. Post reversal formation the stock is witnessing rangebound activity near 200-day SMA.

We are of the view that, the stock has completed one leg of correction and if it succeeds trade above 200-day SMA or Rs 1,465 then we could expect a fresh uptrend rally from the current levels.

For the positional traders now, Rs 1,465 or 200-day SMA is the key level to watch out, above which, the stock could rally till Rs 1,600-1,620. On the flip side, below Rs 1,465, traders may prefer to exit from the trading long positions.

LIC Housing Finance: Buy | LTP: Rs 425 | Stop-Loss: Rs 410 | Targets: Rs 450-462 | Return: 9 percent

After a promising uptrend rally currently, the stock is witnessing profit booking at higher levels. However, the short-term texture of the stock is still in to the positive side. The stock is holding a higher bottom formation on daily charts and it is comfortably trading above 20 and 50-day SMAs which is largely positive.

We are of the view that, as long as it is trading above Rs 410 or 20-day SMA the positive sentiment is likely to continue. Above the same, the stock could move up till Rs 450 and further upside may also continue which could lift the stock till Rs 462.

Expert: Arpan Shah, senior research analyst- research at Monarch Networth Capital

HCL Technologies: Buy | LTP: Rs 1,171 | Stop-Loss: Rs 1,110 | Targets: Rs 1,220-1,275 | Return: 9 percent

The stock has given a fresh upside breakout from consolidation on the daily chart. It has also closed above 21 EMA (exponential moving average) with strong volume support. Momentum indicator MACD (moving average convergence divergence) has also given positive crossover and trading above 0 level.

Traders can look to add at current level and add on dips till Rs 1,150 level, with stop-loss of Rs 1,110. Upside targets are placed at Rs 1,220-1,275 levels.

SRF: Buy | LTP: Rs 2,296 | Stop-Loss: Rs 2,050 | Targets: Rs 2,550-2,650 | Return: 15 percent

The stock is bouncing back from its trendline support level and also defended 100 EMA on the weekly chart. It has defended 100 EMA very strongly in the past and bounced very sharply every time it has reversed from this EMA.

Momentum indicator RSI (relative strength index) also indicating positive crossover on the weekly chart.

Traders can look to add at current level and add on dips till Rs 2,200 with a stop-loss of Rs 2,050. Upside targets are placed at Rs 2,550-2,650 levels.

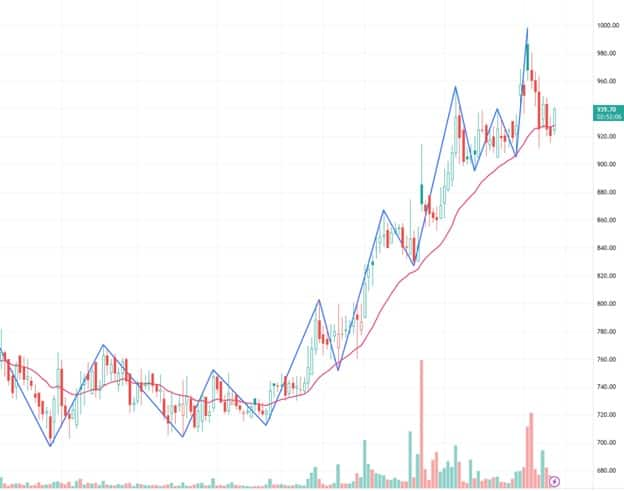

Sansera Engineering: Buy | LTP: Rs 939 | Stop-Loss: Rs 850 | Targets: Rs 1,020-1,070 | Return: 14 percent

The stock has been making higher top- higher bottom formation on the daily chart. Every time it touches 21 EMA, it makes higher bottom and resumes its upside momentum. It has also closed with bullish candlestick formation and heading for the upside target.

Traders can look to add at current level with stop-loss of Rs 850. Upside targets are placed at Rs 1,020-1,070 levels.

Expert: Ruchit Jain, lead research at 5paisa.com

Hindustan Oil Exploration: Buy | LTP: Rs 253 | Stop-Loss: Rs 235 | Targets: 268-280 | Return: 11 percent

The stock has been forming a ‘Higher Top Higher Bottom’ structure and is in an uptrend. Inspite of the recent run up, the volumes have been increasing gradually indicating buying interest in the stock.

The RSI oscillator is hinting at a positive momentum and hence, we expect further upmove in the stock.

Traders can look to buy the stock in the range of Rs 252-248 for potential near term targets of Rs 268 and Rs 280. The stop-loss on long positions should be placed below Rs 235.

Varun Beverages: Buy | LTP: Rs 849 | Stop-Loss: Rs 815 | Targets: Rs 885-910 | Return: 7 percent

\The stock has recently seen a consolidation phase which seemed to be a time-wise corrective phase within an uptrend. In this consolidation, the momentum readings have cooled-off from the overbought zone and the RSI has now given a positive crossover along with the breakout in prices.

Hence, traders can buy the stock in the range of Rs 850-840 for potential near term targets of Rs 885 and Rs 910. The stop-loss on long positions should be placed below Rs 815.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

"control" - Google News

August 14, 2023 at 08:59AM

https://ift.tt/jrHMySL

Top 10 stocks to secure healthy returns as bears gain control over the market - Moneycontrol

"control" - Google News

https://ift.tt/0GboUcg

https://ift.tt/2XnxWaj

Bagikan Berita Ini

0 Response to "Top 10 stocks to secure healthy returns as bears gain control over the market - Moneycontrol"

Post a Comment