China’s central bank is attempting to take control of Ant Group’s vast trove of consumer lending data, marking the latest front in Beijing’s crackdown on Jack Ma’s financial technology group.

Beijing wants to curtail the power of Ant Group and Ma, China’s best-known entrepreneur, who has largely disappeared from public view since publicly criticising state-owned banks and regulators in October. The company was forced to pull its $37bn initial public offering, which was set to be the world’s largest, the following month.

The People’s Bank of China wants Ant to turn over its data, one of the most valuable assets in Ma’s internet empire, to a state-controlled credit scoring company that would be run by former executives of the central bank, according to people close to the negotiations.

The entity would also serve other financial institutions, such as state-owned banks, that compete with the fintech group’s lending operations.

Ant has insisted that it should lead the new company, according to people close to the group. “Too much government intervention will drag the industry down,” said one banker who has worked with Ant.

But the PBoC believed this would create a conflict of interest, according to people familiar with the central bank’s thinking.

“The top priority is to make sure the new business fully complies with regulations,” said one of the people. “State involvement will help [the PBoC] reach that goal.”

The PBoC unveiled rules in January that require Chinese companies to secure government approval before being allowed to provide personal credit ratings. Only three licences have been issued, all to state-controlled entities.

PBoC officials summoned Ant executives to a meeting on April 12, when the group was told to apply for a licence. Ant subsequently confirmed that it would do so.

Authorities have also ordered the company to restructure and fined Alibaba, Ant’s sister ecommerce group, a record $2.8bn this month.

Banks have long complained that Ant has benefited by not being subject to the same stringent regulations to which they must adhere. The company has built a dominant presence in China, with more than 700m monthly users on Alipay, its mobile payments app.

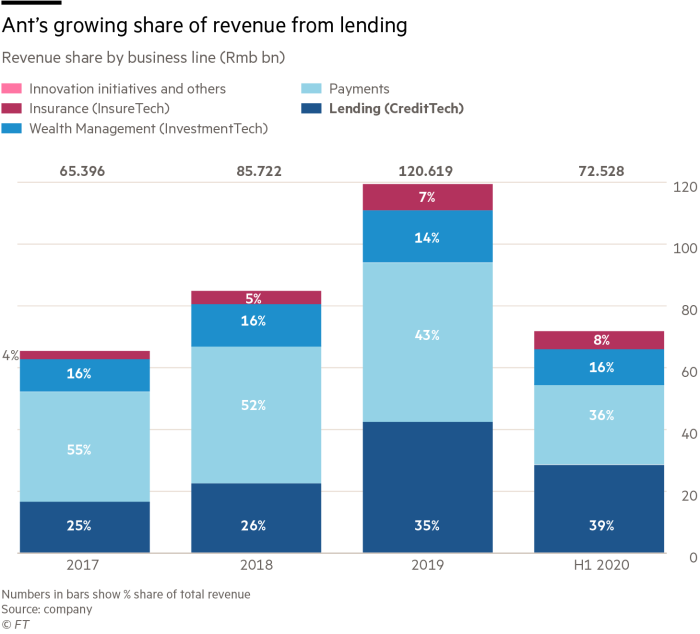

Ant has evolved to also act as a consumer lending platform, with Rmb1.7tn ($262bn) of outstanding loans as of the end of June 2020 — more than any Chinese bank. The tech company charges banks a fee for any loans issued on their behalf.

“There is no question that Ant’s credit data have a lot of value for banks,” said a former PBoC official.

Another person familiar with the central bank’s thinking said: “Ant needs to find a legal way to utilise its data. The solution is to set up a [PBoC-approved] credit reporting company.”

But state control would threaten Ant’s ability to collect and analyse information for core parts of its business, including consumer lending.

“Ant is eager to hold on to its most valuable assets,” said a person familiar with the negotiations.

The central bank will publish a report as soon as Sunday led by Wu Xiaoling, a former deputy PBoC governor, to bolster its argument for a state-controlled data company.

Ant declined to comment.

The PBoC did not reply to a request for comment.

Ant’s supporters argue that existing credit scoring agencies, all of which are government-controlled, are poorly run.

The PBoC’s Credit Reference Center, a government agency, has been subjected to dozens of lawsuits in recent years for reporting inaccurate information and failing to update its data.

One person close to the CRC said its performance had suffered because it collects data through “administrative power”. Ant’s efforts have been underpinned by the popularity of Alipay, and Alibaba’s ecommerce platform. “Lenders lack incentives to [give CRC] high-quality information reporting,” the person said.

Baihang, another state-led credit reporting company, in which Alibaba has an 8 per cent stake, has fared even worse. The agency is headed by a former PBoC official and has struggled to make a profit, in part because Alibaba, Tencent, the tech group that owns Alipay rival WeChat Pay, and other shareholders have refused to share their data with it.

The CRC did not comment.

Baihang did not respond to a request for comment.

"control" - Google News

April 23, 2021 at 11:10AM

https://ift.tt/3vdAR85

China’s central bank fights to control data of Jack Ma’s Ant Group - Financial Times

"control" - Google News

https://ift.tt/3bY2j0m

https://ift.tt/2KQD83I

Bagikan Berita Ini

0 Response to "China’s central bank fights to control data of Jack Ma’s Ant Group - Financial Times"

Post a Comment